| Our team members for setup liaison offices |

Alex Lee l VISA Attorney

SETTING UP LIAISON OFFICES

English, Chinese , Japanese available

Mickey Lee l VISA ATTONREY

SETTING UP LIAISON OFFICES

English available

Jungeun Kim l VISA ATTONREY

SETTING UP LIAISON OFFICES

Japanese available

Lucas Baek l Manager

Dealing with TAX OFFICES

Japanese available

James Kim | Manager

Dealing with banks

English available

Rita Li l Manager

translator

Chinese available

카카오톡( KAKAO TALK ) | 웨이신 (WECHAT / 微信) | 라인 ( LINE /ライン ) | 왓츠앱 ( WHATSAPP ) |

|---|

[zohoForms src=https://zfrmz.com/sRrsEp7fkmnFYoDXd0Cv width=100% height=850px/]

Liaison office of foreign corporations Business in Korea

Nowadays, There are many foreign companies contact us for setting up their liaison offices in Korea

Therefore We would like to guide some information how to register and setup a liaison office in Korea

What business we can do in Korea with the liaison office

The liaison office can’t make a profit in Korea , therefore your company can’t do much with the liaison office in Korea.

Here are the list of activities your company can do in Korea

1. Liaison business

2. Market research

3. R&D activities

4. Non-commercial activities

5. You can perform preliminary and incidental work such as quality control and advertisement.

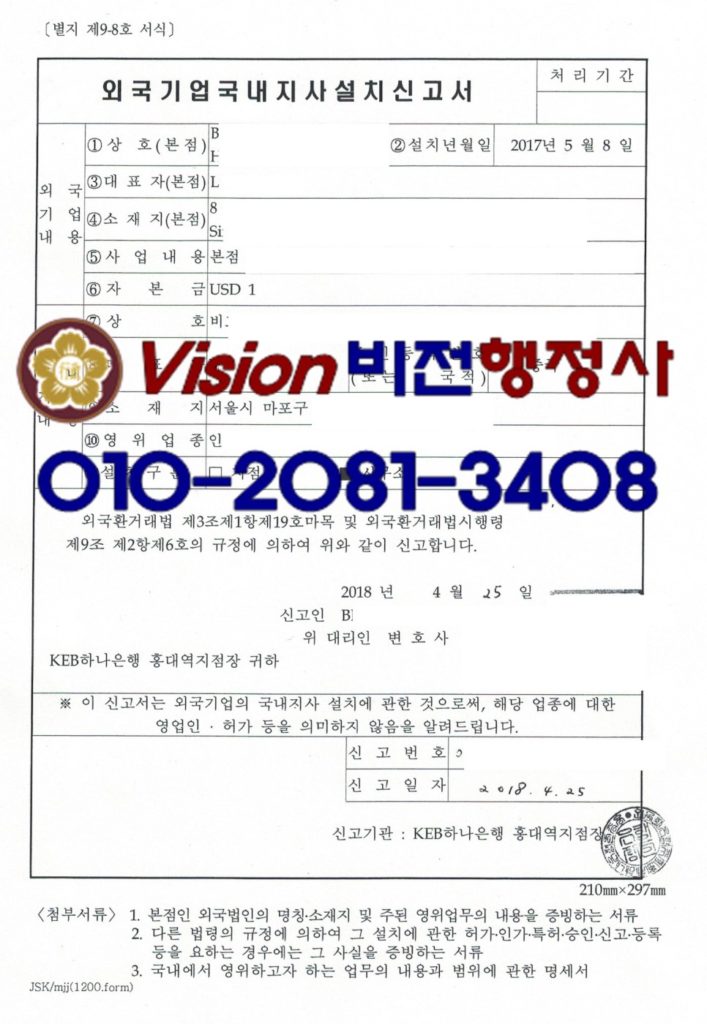

What steps for register the liaison office in Korea ?

In order to register a liaison office in Korea

There are some steps required

Here are the procedure of registering a liaison office

First, Head office information required

Second, We will send you some documents with sample which will need to get apostilled or notarized from Korean consulate in our country

Third , You need to send us original documents by DHL or Fedex

Fourth , We will register the liaison office

Fifth , We will send you a power of attorney to open your bank account if the branch manger is not in Korea to get apostilled or notarized from Korean consulate

Sixth, You need to send us the apostilled POA by DHL or Fedex

Seventh , We open the bank account of the liaison office in Korea

What documents required for register the liaison office in Korea

Register a liaison office is much easier than foreign investment corporation or branch offices

Here are the required documents for the establishment of a liaison office for a foreign corporation in Korea

1. Appointment letter of branch manager

2. A copy of business license of the head office

3. A copy of share holder list of the head office

4. A copy of register documents of the head office

5. A copy of passport of branch manager in Korea

6. A company lease contract of Korea

Can we dispatch employees to Korea ?

Yes, your company can dispatch employees such as mangers or specialist for some fields

but as you know , setup a liaison office is not required investment fund , therefore Immigration offices in Korea are much picky to issue D-7 visas

Required documents for establishing a liaison office include documents that require consular certification or apostille.

After preparing the necessary documents for installation and issuing a unique number, you can open a bank account at a foreign exchange trading bank.

Foreign corporation liaison office installation fee

In general, the cost of setting up a liaison office varies depending on whether it is related to a visa or not.

However, if you simply set up a liaison office, you can generally consider the (notarization fee in your home country + agency fee in Korea + office rental fee in Korea + D-7 visa agency fee).

In the case of offices, in many cases, only the address is leased from a shared office.

If possible, if you rent an office in a place where you can speak a foreign language, you can be contacted immediately about future mail, so you can rent with that in mind.

Fortress, the cost of the liaison office is reasonably well established, so I think it will be possible to set up the liaison office without much trouble.

Laws related to the liaison office of foreign corporations

Enter source

Foreign exchange transaction regulations for domestic branches of foreign companies, etc.

Articles 9~32 (Scope of Application and Classification)

1. A non-resident establishes a branch or office in Korea (hereafter referred to as “domestic branch” in this section). In the case of transfer of funds pursuant to Article 3 (1) 19 (e) of the Act and Article 15 of the Act to operate, the provisions of this section shall be followed.

However, domestic branches and offices of foreign banks shall be subject to the provisions of Chapter 2.

2. Domestic branches of non-residents are classified as follows.

1) Branches that conduct business activities that generate profits in Korea

2) Offices that do not engage in domestic revenue-generating business activities and perform only non-sales functions such as business liaison, market research, liaison and development activities

Articles 9~33 (Installation report and change, etc.)

1. If a non-resident intends to establish a domestic branch, he/she shall report it to the head of the designated foreign exchange bank.

2) Notwithstanding the provisions of Paragraph 1, if a non-resident intends to establish a domestic branch for the purpose of conducting business falling under any of the following subparagraphs or related business, he/she shall report it to the Minister of Strategy and Finance.

1) Loan of funds. Financial-related business other than banking, such as mediation and brokerage of overseas finance, card business, installment financing, etc.

2) Business related to securities business and insurance business

3) Businesses not permitted under the provisions of other laws such as the Foreign Investment Promotion Act

3. A person who intends to file a report pursuant to Paragraphs 1 and 2 attaches the following documents to the Foreign Company Domestic Branch Establishment Report in Attachment No. 9-8 to the Minister of Strategy and Finance or the head of a designated foreign exchange bank. must be submitted

1) Documents supplementing the name, location, and main business of the foreign corporation of the head office

2) In the case where permission for installation is required under the provisions of other laws and regulations, a copy of the document proving the fact

3) A statement of the content and scope of the business to be conducted in Korea

4. If a person who reported on the establishment of a domestic branch wants to change the reported details, he/she must attach the documents falling under each of the following subparagraphs to the change in the establishment of a domestic branch of a foreign company in Attachment No. 9-9. must be submitted to

1) Documents proving the fact of change

2) Business plan (when the branch office changes its business details)

Articles 9~34 (Introduction of operating funds, etc.)

1) When a domestic branch intends to introduce operating funds from a foreign head office, it must introduce it through a designated foreign exchange bank.

2) The head of a designated foreign exchange bank of a domestic branch shall report the operating funds introduced in accordance with the provisions of Paragraph 1 to the Governor of the Bank of Korea by the end of February of the following year for each year, and the Governor of the Bank of Korea shall notify the Governor of the Financial Supervisory Service. .

Articles 9~35 (External remittance of net income from settlement of accounts)

1) In the event that the branch that has reported the establishment in accordance with the provisions of Articles 9~33 intends to remit the net income from the settlement of accounts to a foreign country, the remittance must be made through the designated foreign exchange bank.

2) A person who intends to make a remittance pursuant to the provisions of Paragraph 1 shall submit the application for remittance of net income from the domestic branch of a foreign company in the attached form No. 9 to No. 10 to the head of the designated foreign exchange bank with the following documents attached. However, in the case of a branch that has reported establishment to the Minister of Strategy and Finance pursuant to the provisions of Articles 9-33, Paragraph 2, it may be replaced with a permit, etc. according to the relevant laws and regulations on the external disposition of net income from settlement of accounts.

(1) The branch’s balance sheet and income statement

(2) proof of tax payment

(3) If the ratio of the net income of the current accounting period to the amount introduced into the operating fund is 100/100 or more or the net income exceeds 100 million won, an audit certificate by a certified public accountant

Articles 9~36 (Now of Reduced Operating Funds) Operating funds that have been reduced in accordance with the procedures stipulated by relevant laws and regulations by branches (limited to financial institutions) that have reported establishment in accordance with Articles 2-11 and 9~33 Articles 9~35 (2) shall apply mutatis mutandis in the case of remittance to a foreign country.

Closing after establishment of liaison office of foreign corporation ( Liaison office )

Articles 9-37 (Closing, etc. of Domestic Branches)

1) If a person who has filed a report on establishment of a domestic branch in accordance with the provisions of this section intends to close a domestic branch, he/she must submit a notification of closure of a foreign company’s domestic branch office in Attachment No. 9~11 to the person who reported the establishment.

2) In the case where a person who has filed a closure report pursuant to Paragraph 1 intends to remit the proceeds from the disposal of assets held in Korea to a foreign country, he/she shall submit a tax payment certificate issued by the head of the competent tax office of the relevant domestic branch to the head of the foreign exchange bank for the designated transaction.